Immigrants comprise nearly 20% of the American workforce. Their share of the workforce has grown steadily over the last 15 years and more rapidly since 2020 as immigrants have returned to work more quickly post COVID-19 than their U.S.-born colleagues. While the U.S. economy increasingly relies on the labor that immigrants provide, immigrants have not driven U.S.-born workers from the labor market. The employment rate, prime-age labor force participation rate, and number of U.S.-born workers remain at or above their highest levels in 20 years.

Rather, immigrants have boosted the U.S. economy and will continue to do so. The Congressional Budget Office expects immigration to add an average of 0.2 percentage points to the country’s annual GDP growth rate over the next 10 years. One way that immigrants boost the economy is by filling gaps in the U.S.-born supply of labor. Immigrants are overrepresented in key industries and often work in occupations that complement or support other jobs. In addition, gaps in the U.S.-born supply of labor are becoming more pronounced amid a “Great Retirement Boom” driven by the country’s aging population and increase in early retirements post COVID.

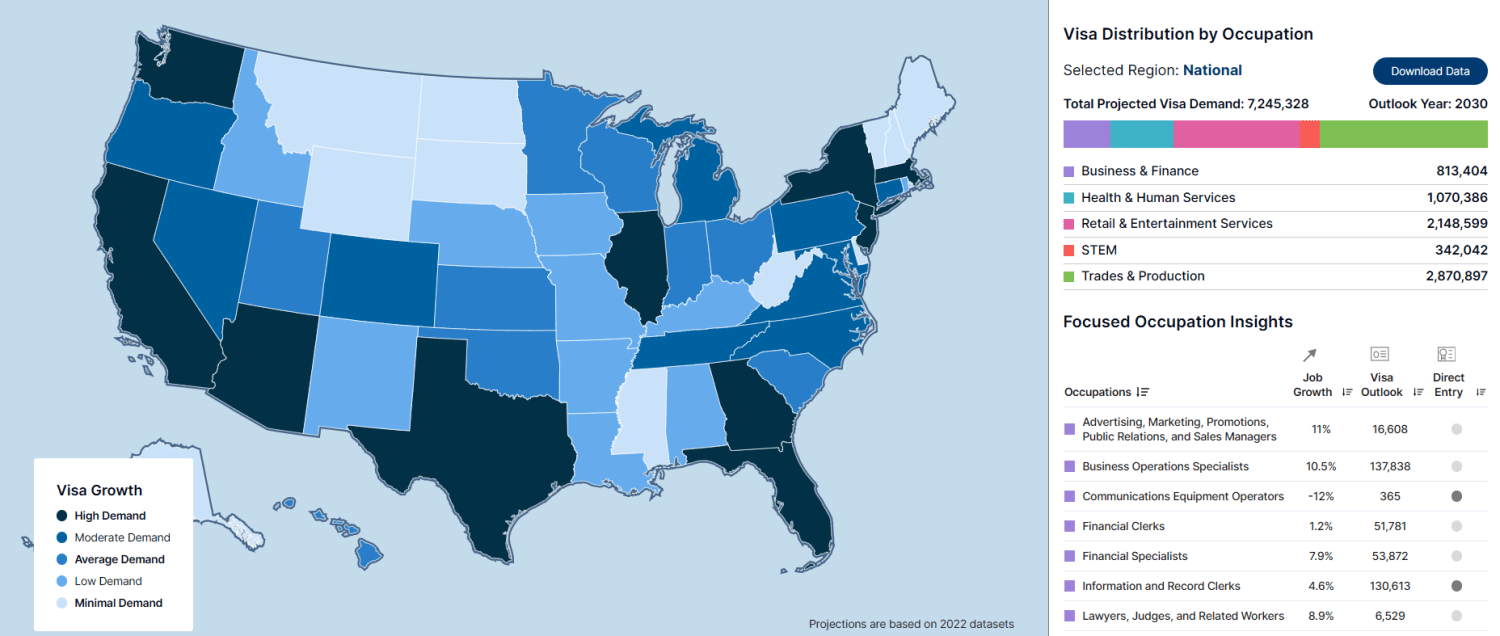

The country’s reliance on foreign-born labor will almost certainly continue to grow, but it will not grow uniformly across states and occupations. To illustrate the sharp differences in projected demand for immigrants and visas across geographies and occupations, the Brookings Institution’s Workforce of the Future initiative created the Visa Outlook Explorer, which projects targeted immigrant needs through 2030. In short, we combine the projected demand for all workers in a state and occupation with data on the current composition of immigrants in those jobs. This provides a benchmark for the future demand for immigrant workers due to the natural growth in employment. We then also account for new visa demand due to retirements or other labor force exits, again assuming that immigrants will fill these positions in proportion to their current workforce share. The result is an estimate of future demand for work visas across occupations and states.

The Visa Outlook Explorer shows that the highest demand for new work visas in the U.S. through 2030 will be in the Trades and Production occupations.

At the national level, the Visa Outlook Explorer shows that Trades and Production occupations will have the highest demand for new work visas through 2030 due to those occupations’ large share of overall employment and heavy reliance on foreign-born workers. Though the share of foreign-born workers in Retail and Entertainment occupations is about half that of Trades and Production occupations, these jobs will also experience a high demand for new work visas due to their fast employment growth and high rate of retirements.

Across states, those with larger populations and higher shares of immigrants, such as California, Texas, and New York, are (unsurprisingly) projected to have the highest demand for new visas through 2030. Similarly, because of their large existing populations of immigrants, New Jersey and Illinois can also expect a high demand for new visas (ranking fifth and sixth, respectively, among states) despite relatively low expected overall job growth (ranking 26th and 37th, respectively). In contrast, states such as Tennessee and Utah can expect a relatively high demand for new visas because of their high expected job growth (ranking ninth and first, respectively), and despite a relatively low share of immigrants in the workforce.

The Visa Outlook Explorer makes clear the local and occupation-specific importance of immigration policymaking. The tool’s insights, and the research that supports it, can bolster congressional efforts to fill gaps in the labor market—for instance, by ensuring migrant farmworkers are documented, by expanding the H-2B visa cap for non-agriculture temporary workers, by reviewing and approving asylum claims at a higher rate, or perhaps by considering a new state-based visa program.

As the U.S. workforce continues to grow, and as old workers retire and new workers begin careers, the foreign-born workforce will remain essential. The Visa Outlook Explorer offers a data-driven snapshot of what policymakers can expect for their own labor markets over the next decade. We believe the tool will foster a healthy dialogue founded on realistic expectations for local labor markets in the years to come.

Commentary

Which US states and occupations are most in need of foreign-born labor?

Introducing a new tool for policymakers

June 14, 2024